In the living rooms of 2026, entertainment has never been more abundant — or more fragmented. A decade ago, streaming felt like liberation. No cable boxes, no commercials, no waiting for prime time. The promise was simple: unlimited content, on your terms. But somewhere between the fifth subscription and the sixth price hike, that dream turned into something messier. The so-called “Streaming Wars” — once a catchy industry term — have become a defining cultural and economic battle for attention, time, and identity.

Now, two decades after Netflix first started the revolution, the question isn’t who’s streaming — it’s who’s still standing.

Act One: The Golden Age Gives Way to Saturation

The early 2020s were a period of explosive growth. Everyone wanted in. Netflix, Disney+, HBO Max, Amazon Prime Video, Apple TV+, Peacock, Paramount+, Hulu, and a dozen smaller players all flooded the market with original content, chasing the next big franchise. The “content gold rush” was on, and for a time, it felt endless.

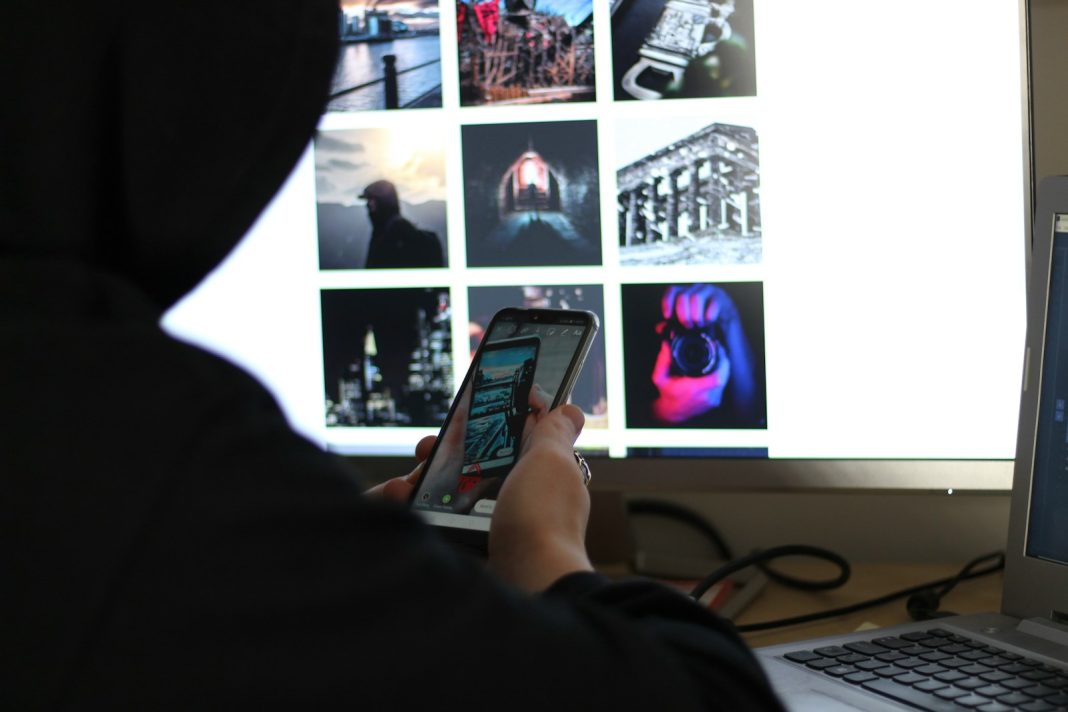

But viewers — the real prize in this war — began to feel the fatigue first. Subscription creep became the new cable bundle. Instead of saving money, many found themselves paying more — hopping between platforms, juggling free trials, and chasing exclusive shows like fugitives in a digital maze.

By 2024, the honeymoon was over. Growth stalled, cancellations surged, and even giants like Netflix saw slowing subscriber counts in mature markets. The bubble didn’t pop outright — it deflated, forcing every major player to ask the same question: how do you survive in a saturated market when everyone’s already streaming?

Act Two: The Reshuffling of Power

The past two years have seen a dramatic reshuffling of the streaming hierarchy. The old model — more content equals more subscribers — no longer works. Quality, identity, and community have become the new battlegrounds.

Netflix, the pioneer, remains the most recognizable name, but not the undisputed leader it once was. After years of global dominance, it faced competition not from copycats, but from specialists. To its credit, Netflix pivoted smartly. By 2025, it had embraced live programming — from stand-up specials to sports-lite offerings like “Netflix Fight Night.” Its global content pipeline, especially from South Korea, Spain, and India, continues to set it apart. What keeps Netflix in the game isn’t just content — it’s data. No one understands viewer habits better, and no one adapts faster.

Disney+, meanwhile, stands as the closest rival, though it’s evolved from family-friendly fortress to multi-layered empire. The merger of Hulu and Disney+ into a single “super app” in 2024 streamlined the experience, while new live sports bundles with ESPN+ have made it a powerhouse of both nostalgia and event programming. From Star Wars to The Simpsons, it owns the cultural past — and now it’s betting big on interactivity. Rumors suggest Disney is developing choose-your-own-story formats for its next generation of content, bridging gaming and streaming in a way that feels… well, very Disney.

Then there’s Amazon Prime Video, the quiet juggernaut. While others chase prestige, Amazon plays a different game: ecosystem dominance. Prime Video doesn’t need to make a profit on its own; it exists to make Prime indispensable. In 2026, it’s less about shows and more about integration — one click to order, watch, and even shop for what you see on screen. Their AI-driven “Watch & Buy” tech, which allows viewers to purchase items featured in shows, has become surprisingly popular, blurring the line between storytelling and commerce.

Act Three: The New Contenders

But perhaps the most interesting shifts in 2026 aren’t among the titans, but the insurgents.

Apple TV+, once considered a side project for a trillion-dollar company, has carved out a distinctive niche: prestige minimalism. While Apple’s library is smaller, its hit rate is unmatched. After Severance, Foundation, and Silo, it became clear that Apple doesn’t chase quantity — it curates. Its sleek interface, immaculate visuals, and loyal subscriber base give it an aura of quiet sophistication. Apple’s model isn’t about bingeing — it’s about experience. In an era of content exhaustion, that restraint feels refreshing.

Meanwhile, Paramount+ and Peacock — once derided as legacy leftovers — found their footing through consolidation. Paramount merged with Warner Bros. Discovery to form “Paramount Warner” in 2025, combining libraries of Game of Thrones, Mission: Impossible, and Yellowstone. It was a survival move that worked. Suddenly, they had depth — blockbuster franchises, sports rights, and decades of cinematic history under one roof.

Even niche platforms are thriving. Crunchyroll dominates anime; BritBox still charms Anglophiles; and smaller apps like Criterion Channel have proven that focus, not scale, can sustain loyalty. In the chaos of the streaming wars, specialization has become strategy.

The Global Front: Where the Real Battle Is Fought

If the American streaming market has plateaued, the global one is still a battlefield. Latin America, Southeast Asia, and Africa are now the growth engines of the industry, and every major platform knows it.

Netflix remains a front-runner internationally thanks to its localization efforts — dubbing, subtitles, and a keen eye for local stories that resonate globally (Money Heist, Squid Game, Lupin). Disney follows closely, leveraging its family appeal, while Amazon focuses on regional partnerships and affordable mobile plans.

But the surprise player in 2026 is Tencent Video, China’s streaming giant, which has begun expanding beyond its borders through partnerships and co-productions. In markets like Indonesia, Nigeria, and Brazil, Tencent-backed platforms are quietly eating into Western dominance by offering low-cost access and culturally resonant stories. The streaming war, once a Hollywood game, is now a truly global conflict.

Streaming Meets AI: The Age of Hyper-Personalization

In 2026, artificial intelligence isn’t just a marketing buzzword — it’s the invisible editor behind your viewing experience.

Platforms now tailor not just recommendations, but presentation. Two users watching the same show might see different trailers, thumbnails, or even episode orders, depending on their engagement patterns. Some platforms are experimenting with adaptive storytelling — interactive episodes that subtly change pacing or tone based on your reactions (tracked via smart TVs or wearables).

Netflix’s “SceneFlow” technology, for instance, customizes highlight recaps based on what you skipped or rewatched. Disney’s AI now adjusts content warnings and parental controls dynamically, analyzing viewing patterns across family profiles.

It’s all meant to make streaming feel personal — intimate even — but it also raises ethical questions. How much control is too much? When your screen knows you better than you know yourself, does convenience start to look like manipulation? The answer, like the algorithm, is complicated.

The Return of Advertising (And the Irony of It All)

Remember when streaming was supposed to end ads? Welcome to 2026, where ads are back — but smarter.

Most platforms now offer tiered models: pay more for ad-free, pay less to watch “curated interruptions.” But these aren’t the old 30-second spots. Using AI, advertisers can dynamically insert context-aware ads into streams — a sports drink ad after a marathon scene, or a fashion brand during a rom-com montage.

The result? Ads that feel less intrusive and more… ambient. For viewers tired of price hikes, ad-supported plans have actually become the norm again. It’s a full-circle moment — streaming, once the antidote to cable, has evolved into its digital reincarnation, only now more personalized and profitable.

So, Who’s Winning in 2026?

In truth, no one has won — and perhaps that’s the point. The war has shifted from domination to coexistence. The real winner isn’t the platform; it’s the ecosystem.

Netflix leads in global reach. Disney+ dominates brand power. Amazon owns integration. Apple commands prestige. Paramount Warner thrives on legacy. Each has found a lane — and for the first time, that might be enough.

For viewers, the battlefield has moved to the interface: how easily you can navigate, bundle, and personalize. Aggregator platforms like ReelHub and StreamSmart — which unify your subscriptions into one screen — are emerging as peacekeepers in this fragmented universe.

In the end, the streaming war of 2026 isn’t about who conquers the most subscribers. It’s about who earns the most trust — the platform that feels most essential, most human, in a landscape built by machines.

The Final Frame

When the history of entertainment is written, this era will be remembered not as the age of chaos, but of transformation. Streaming has reshaped how stories are told, shared, and valued. It’s blurred borders, democratized content, and made creators out of consumers.

And yet, amid the noise of mergers and metrics, one truth endures: audiences still crave connection. Whether through a Korean thriller, a nostalgic sitcom reboot, or a live concert streamed across continents, we’re all searching for the same thing — stories that remind us who we are.

Maybe that’s the real ending to the streaming war. Not victory, not defeat, but evolution. The screens keep multiplying, but the story — our story — remains the same.